Summary of the Intrusive Lithostratigraphy and Geochronology of the Cupriferous Retreat Batholith, Clermont, Queensland

Robert H. Findlay

MAIG

Lindisfarne, Tasmania 7015, Australia.

Click here to download article as PDF

Abstract

The Clermont district of Queensland is well-known for historical small-scale copper and gold mining. The Neoproterozoic-Cambrian Anakie Metamorphic Group contain zones of lower greenschist facies metabasite hosting possible VMS copper shows together with limited outcrops of related ultramafic rocks with Ni/Pt/Pd possibilities. The Anakie Metamorphic Group is intruded by the predominantly granodioritic, monzonitic and gabbroic assemblage of the Middle-to-Late Devonian Retreat Batholith. In the study area these intrusive rocks display sporadic, fracture-hosted shows of malachite and azurite with associated “green-rock” alteration along a 14km strike length between the Rosevale and Consols-Savannah areas.

Between 2013 and 2015 Diatreme Resources Ltd, in a joint venture with Antofagasta PLC, carried out a detailed exploration programme involving 1:2000 and 1:5000 geological mapping supported by a limited petrological study, detailed study of approximately 14km of legacy and new diamond drill-core, RC and RAB drilling and geochronological studies along the cupriferous zone within the Retreat Batholith. This project not only has enabled a clear understanding of the timing of intrusion and mineralisation but has also given an indication of the possible sub-surface source for the mineralisation at the Rosevale prospect in this lithostratigraphically complex region. This project consolidated prior regional campaigns of investigations of soil geochemistry, geophysics, prior cored diamond and RC drilling and limited geological mapping by Diatreme Resources and precursor companies.

Keywords: Intrusive Lithostratigraphy, Geochronology, Mineralisation

The Massive Australian Precambrian-Cambrian Impact Structure (MAPCIS) part one

Daniel P. Connelly1, Arif M. Sikder2, Jaime L.B. Presser3

1 MAPCIS Research Project, 4815 Covered Bridge Rd, Millville, NJ 08332.

2 Centre for Environmental Studies (CES), Virginia Commonwealth University (VCU), 1000 West Cray St., Richmond, VA 23284.

3 jaimeleonardobp@gmail.com Geoethics, Paraguay Chapter

Click here to download paper as PDF

Introduction

MAPCIS is a marine oblique impact hitting the Centralian Superbasin over thick continental crust with a northeast to the southwest trajectory centered at 25°32’55.66″S 131°23’21.50″E with initial contact about 140 km to the northeast creating an approximately 600km diameter complex peak ring crater with bilateral symmetries, uprange-downrange components along with an exposed circular crater rim. MAPCIS is age constrained to end Ediacaran/early Cambrian consistent with pЄ-Є boundary. We will show panoply of mega, macro, micro and elemental evidence to support the age, size, trajectory and location of this impact with this and successive papers. We will finish with the implications of MAPCIS changing our understanding of geology and Earth history. This first paper is authored primarily by Daniel Connelly.

The Inca uraniferous skarn Namibia: an unusual magmatic-hydrothermal deposit

Andy Wilde

Click here to download paper as PDF

Abstract

Inca is a skarn-hosted magmatic-hydrothermal uranium deposit located in the Erongo district of Namibia. It differs in several key ways from typical intrusive uranium deposits of the region, principally because uranium occurs in skarn rather than in leucogranite intrusions. Preliminary observations presented here suggest that Inca is the product of the separation of a uraniferous hydrothermal fluid from leucogranite magma. This was the result of magma interacting with marble as hypothesized by Cuney (1980). Inca is one of only two economically significant skarn-hosted uranium deposits in the world. The other is the Mary Kathleen deposit, near Mount Isa in Queensland. Uranium deposition at Inca is paragenetically linked to skarn formation. At Mary Kathleen, however, uranium was introduced over 200 Ma after the formation of the host skarns. Inca is thus unique.

The above paper may be downloaded in Adobe Acrobat (pdf) format (2.8mb) by clicking on the link above or opposite.

Real Options Valuations: A new way of valuing mining projects

First presented at the AIG Mineral Exploration Discussion Group Western Australia meeting, October 2004.

Dr Pietro Guj

Click here to download paper as PDF

The above paper may be downloaded in Adobe Acrobat (pdf) format (8.9 Mb) by clicking on the link above.

Epithermal Gold for Explorationists

Greg Corbett, Consultant Geologist

AIG Presidential Lecture 2001-2002

Click here to download paper as PDF

ABSTRACT

Epithermal gold (± Cu & Ag) deposits form at shallower crustal levels than porphyry Cu-Au systems, and are primarily distinguished as low and high sulphidation using criteria of varying gangue and ore mineralogy, deposited by the interaction of different ore fluids with host rocks and groundwaters. Low sulphidation deposits are in turn further divided according to mineralogy related to the depth and environment of formation, while high sulphidation systems vary with depth and permeability control, and are distinguished from several styles of barren acid alteration.

Low sulphidation epithermal Au + Cu + Ag deposits develop from dilute near neutral pH fluids and are divided into two groups: those which display mineralogies derived dominantly from magmatic source rocks (arc low sulphidation), and others with mineralogies dominated from circulating geothermal fluid sources (rift low sulphidation). The former are classed with decreasing crustal level as: quartz-sulphide gold + copper, passing to polymetallic gold-silver veins, carbonate-base metal gold and shallowest epithermal quartz gold-silver. These ore types are zoned in time and space with shallower styles overprinting the deeper, and metal contents which vary as high Cu at depth, to Ag and Au dominant in elevated crustal settings. Low sulphidation adularia-sericite epithermal gold-silver systems comprise the rift low sulphidation style. These are dominated by gangue mineralogies deposited from meteoric water rich circulating geothermal fluids, typically formed in rift settings. Sediment hosted replacement gold deposits are interpreted to develop from low sulphidation fluids in reactive carbonate bearing rocks.

High sulphidation Au + Cu ore systems develop from the reaction with host rocks of hot acidic magmatic fluids to produce characteristic zoned alteration and later sulphide and Au + Cu + Ag deposition. Ore systems display permeability controls governed by lithology, structure and breccias and changes in wall rock alteration and ore mineralogy with depth of formation. One of the challenges is to distinguish the mineralised systems from a group of generally non-economic acidic alteration styles including lithocaps or barren shoulders, steam heated, magmatic solfatara and acid sulphate alteration.

The JORC Code – A Banker’s View

Quentin Amos, Head of Precious Metals, HSBC Bank Australia Limited, and

Phil Breaden, Consulting Director, Westpac Institutional Bank.

Note: The following paper represents the views of the authors and not necessarily those of HSBC Bank or Westpac.

Introduction

The JORC Code (the “Code”) “sets out the minimum standards, recommendations and guidelines for Public Reporting of exploration results, Mineral Resources and Ore Reserves in Australasia” (JORC, 1999). The Code goes on to define Public Reporting as a report “prepared for the purpose of informing investors or potential investors and their advisers”, and as the Australian and New Zealand Stock Exchanges have adopted the Code into their listing rules, it is natural that companies focus their attention on the needs and requirements of the equities markets.

However the banking community also relies on reserve estimates and reports in evaluating whether or not to advance finance to the resources company. This paper focuses on the understanding, use and reliability of reserves estimates produced under the Code for banking purposes and expresses some concerns of the authors which we believe are shared by the banking community.

Hedging At Its Most Basic

Ian Levy, Gympie Gold

Click here to download paper as PDF

INTRODUCTION

Do this as a worked example – it saves words.

The gold price has “jumped” to A$500 per ounce and we, the Miner, want to lock this “good” price in for 1,000 ounces to be delivered in exactly 12 months time.

Rates For This Example

Spot price = A$500 per ounce.

Australian 12 month cash interest rate = 7%

12 month gold lease rate (or gold borrowing fee) = 2%

Banker’s profit margin = 0.25% (depends on “credit rating”)

How Hedging Happens

- Miner (ie. our company) advises its “dealer” counterparty (eg. Rothschild Bank) to sell 1,000 ozs forward for 12 months at this spot price.

- Dealer immediately borrows 1,000 ozs of gold from a major Central Bank (eg. Bank of England) and sells it into the spot market: Dealer raises 1,000 x 500 = $500,000 cash and promises to repay the gold in 12 months plus the interest rate charged by the central bank on gold, usually called the gold lease rate or more legally, the gold borrowing fee.

- Dealer’s bank (eg. Rothschild) immediately invests the $500,000 onto the cash interest rate market to earn normal interest minus the lease rate.

Therefore, in 12 months time, Dealer can pay Miner more than the $500,000 for 1,000 ounces of gold because the Dealer:

| Still has the $500,000 it raised on the 1,000 ozs | $500,000 |

| Earns cash interest on the$500,000 of 7% | $35,000 |

| Pays the gold borrowing fees of 2% | $10,000 |

| Takes a bankers fee of 0.25% | $1,250 |

| Net amount payable to Miner | $523,750 |

So, all Miner needs to do is deliver 1,000 ozs of gold to Dealer in 12 months time to receive $523,750 – an effective gold price of $523.75 per ounce.

Nobody has “bet” against the miner/dealer, this all happens because of the prevailing interest rates for cash and gold loans. Nobody loses if the gold price falls below $500 in 12 months time. Miner loses an opportunity to make more money if the gold price rises above $523.75 in 12 months time because the 1,000 ozs must be delivered into the $523.75 contract with the Dealer so that the gold can be returned to the Reserve Bank.

And that is all that happens in basic gold hedging, the rest is jargon and variations on this theme.

We complicate this process a bit by paying a fee or taking a fee and contractually making the hedge transaction optional for one or other party. Option pricing is beyond the scope of this note. Options are a valid activity and are actually not overly complex until we start creating multiple-option “derivatives”.

Geophysics in Northwest Queensland – Improving the Use of Electrical Geophysics

J.G. Donohue and S.N. Sheard, MIM Exploration Pty Ltd

Click here to download paper as PDF

Introduction

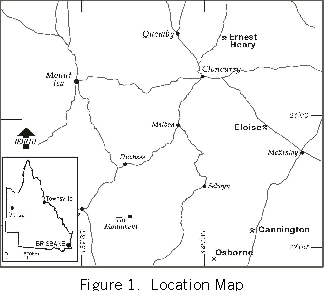

Conventional geophysical techniques have been applied in North West Queensland to assist in locating economic mineralisation for some considerable time. The value of large scale airborne surveys such as magnetics, radiometrics and electromagnetics in both mapping and direct detection has been shown in the last decade with such discoveries as Cannington and Osborne (Anderson and Logan, 1992) by targeting discrete magnetic highs (Figure 1).

Ground techniques such as electrical geophysics have been responsible for at least two discoveries in the North West Queensland region in the last decade. Both Ernest Henry (Webb and Rowston, 1995) and Eloise (Brechannini and Asten, 1992), were found by drilling time domain electromagnetic anomalies (Figure 1). These ore bodies are situated in the Eastern Succession of the Mount Isa Inlier. (more…)

Ground techniques such as electrical geophysics have been responsible for at least two discoveries in the North West Queensland region in the last decade. Both Ernest Henry (Webb and Rowston, 1995) and Eloise (Brechannini and Asten, 1992), were found by drilling time domain electromagnetic anomalies (Figure 1). These ore bodies are situated in the Eastern Succession of the Mount Isa Inlier. (more…)

The Mount Garnet Zinc Skarn Deposit

Ian Morrison1 and Joe Treacy2

1Lantana Exploration Pty Ltd, 2Kagara Zinc Ltd

Click here to download paper as PDF

Introduction

Kagara Zinc Limited is currently undertaking a programme of detailed infill and ore delineation drilling at the Mt Garnet zinc skarn deposit. A feasibility study will then be completed to assess the viability of mining. If successful, development should commence within 12 months.

The global resource currently stands at 3.94 Mt at a grade of 6.5% ZnE (Zinc Equivalent) calculated at 3% ZnE cut-off; measured and indicated resources comprise roughly 65% of this global resource (Kagara Zinc Ltd prospectus, 1999). The current drilling programme has revealed high grade mineralisation below the previously interpreted base of the orebody which will add substantially to the resource. It is expected that re-optimisation of the planned open pit will include a substantial amount of this ore. (more…)

Recent Developments in Geology, Exploration and Production at the Mt Gordon Copper Mine

Anthony M Hespe, Western Metals Ltd

Click here to download paper as PDF

Introduction

Gunpowder– now called Mount Gordon – will be a familiar name to those who have worked in the mining industry in Queensland. It has a history of intermittent copper production, attempts at novel treatment processes and periods of closure dating back to the 1920s. Recent developments in geology, exploration and production, which have transformed the economics of the deposit, are the subject of this presentation.