Where Have All The Geoscientists Gone

Michael Leggo | michael.leggo@boral.com.au

Michael Leggo | michael.leggo@boral.com.au

Paper initially presented at the AIG Annual General Meeting, Sydney, 23 May 2002.

Click here to download paper as PDF

INTRODUCTION

In accepting the opportunity to talk at the AGM, I had rather naively hoped to discover that the general pessimism about the current state and foreseeable future for geoscientists was exaggerated. Regrettably, in researching this topic, I have had to face up to some unpalatable realities. I plan to comment on these, but then to suggest some hopefully appropriate courses of action.

The more I delved into the topic, the more the information and questions mounted. Being fortunate enough to still be in full-time employment, I regret I have not had time to be as thorough as I would have liked. I particularly want to thank Ian Neuss, Andrew Waltho, John Kaldi, Colin Ward, Bryan Smith, Ken Harvey and John Bryan for helping to reduce some of my deficiency of knowledge. I should also state that I have shamelessly lifted and used information and ideas from wherever I could get them. About the only thing that is my own work is probably the actual synthesis.

I believe that what geoscientists are facing is not just the by now familiar perturbation or cyclical downturn driven by world economic conditions or poor commodity prices, but rather a much larger evolutionary change that commenced more than a decade ago.

REALITIES

The realities are:

- The developed world economies have evolved from being industrial- to information- and service-based.

- On average the real return on capital of operating mining companies (top 50) has been only 5 percent over the last 20 years, ie. below the cost of capital, thus resulting in a loss of shareholder wealth (ignoring the 7000 or so junior companies, with a normal three-year life span, that have come and gone in this time).

- Combined market capitalisation of the mining sector has declined to about 1% of the total world capital market.

- The capitalisation of resource stocks as a percentage of the ASX has fallen over 10 years from 37% to 14%.

- Ironically the reduced economic contribution by mining is due in part to the superb efficiency of this sector – a level of profitability has been maintained by increased mining efficiency (declining costs of production and increased production volumes), but at the cost of making the supply situation worse; there has been a long-term average decline in metal prices of around 2-4% per annum in real terms.

- This has been compounded by political and modern business cycles being much shorter than the normal mining cycle, viz. once a mine goes into development it is almost impossible to react to changing economic circumstances by changing plans without incurring tremendous losses; mining is a “price taker”.

- In developed countries, public attitudes and government policies toward domestic resource industries have become neutral or unsupportive, ie. there has been a reduction in direct and indirect “subsidies” by society in those countries.

- There has been a major shift of exploration, development and production to the developing world and this is part of the larger globalisation phenomenon. This shift has resulted from the pull exerted by under-explored countries, their improved attractiveness as they have moved to market-driven economies, and the apathy (sometimes hostility) to the industry in the developed world.

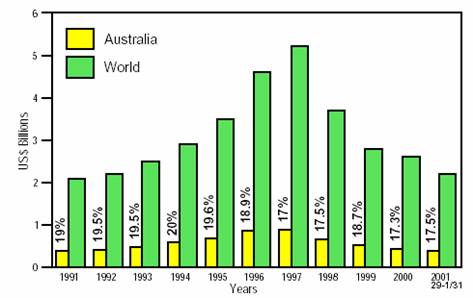

- Global mineral exploration more than doubled from 1991 to 1997 peaking at US$5.2B before falling to a low of US$2.2B in 2001.

- The ratio of exploration expenditure to the gross value of metal production in the 1990s was 3.6% compared with an historic average of 2.4%, and 1.1% in the 1950s, ie. the 1990’s were anomalous.

- Globally there have been static or declining rates of giant or world-class deposits discovery, particularly when pro-rated against levels of exploration expenditure – average discovery costs have tripled in the last 30 years.

RESULTS

The results are:

- The poor rates of return for mining fall well short of those offered by other market sectors and also the thresholds demanded by shareholders and fund managers, ie. mining faces intense competition for capital from the “new economy” sectors.

- There has been a loss of confidence in the exploration process as a cost-effective means of achieving acceptable company growth.

- A dramatic fall has occurred in mining-related capital raising and in the number of new floats since 1997 in all the major centres for mining finance.

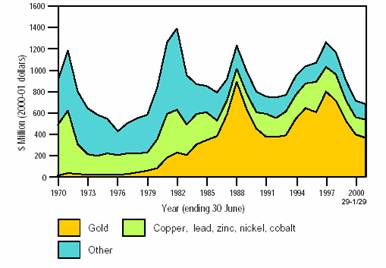

- In constant 2000/2001 dollars, mineral exploration in Australia is at a 20 year low ($683.3M last financial year; down 40.5% on the 1996/97 peak (Figure 1), and even then this is misleading since expenditure is mainly on “brown-field” exploration); Australian exploration spending over the past decade has directly followed the global mineral exploration pattern (Figure 2).

- Consolidation of the industry has occurred through mergers and acquisitions (US$128B in the last six years) with the merged companies inevitably reducing their exploration effort (by a factor estimated to be of the order of 2+2 reducing to 1.5).

- Fairly robust estimates put the number of geoscientists working Australia (in all fields) in 1996 at around 5200. Currently there are approximately 2600, with about 14% of these being unemployed. It is important to look at the distribution of these geoscientists to understand the effect of the reduction in mineral exploration. Figure 3 is a best estimate based on the Directory of Australian Geoscientists, but the percentages appear to be low for Coal and Government.

- Geoscience as an academic discipline in Australian universities has been diluted, with geology now most commonly found in mixed administrative units, eg. together with other physical or biological sciences, geography or environment.

Figure 1. Australian mineral exploration expenditure 1970-2001

Figure 2. Global mineral exploration expenditure

Figure 3 Geoscientists employment by sector (by %)

- There is currently a “trough” in undergraduate numbers and students are commonly undertaking double degrees (thus keeping their options open?)

- The Resources industry is dominated by Minerals; the high attrition in mining colours the perception of geoscience as a whole and “blocks” entry into the Petroleum and Coal industries because of late specialisation in these fields in the undergraduate or post graduate process. The workforce in the oil and gas industry is aging and employee numbers are dwindling through attrition – there is a serious shortage of young geologists.

- In the Coal industry in the period from the mid 1990s to the present, coal production in Australia has increased; the number of geologists has also increased slightly to the current level of about 110 despite actual coal exploration expenditure falling by 41%. There is a significant drop-out rate after 1-2 years of employment and there is a shortage of new graduates.

- The principal federal government geoscientific body, Geoscience Australia, appears to have changed over time in its scale and emphasis, and it has reduced its capacity to produce basic geoscientific data of practical use to the mining industry. However, federal spatial data is now available free or at the marginal cost of transfer.

- State Government mineral resources agencies vary markedly in their approach to producing and providing information to promote exploration in their States, from a number of aware, pro-active and well-funded bodies to those that are diminishing and ineffective. This variation does not apply to their ability to act as guardians of geological data generated by the private sector, which is to world’s best standard.

NEGATIVES

The negatives are:

- There is serious potential for a major negative impact on Australia’s minerals export earnings in the longer term (2000/01 value of exports of minerals was $40 billion excluding iron ore, and $56.4B including iron ore and petroleum which equates to 64% of total commodity exports). These earnings contribute substantially to the nation’s standard of living; note however the bias engendered by thinking that mining is synonymous with the production of high unit-value base and precious metals.

- It is likely that there is a partitioning of the geoscientific workforce on the basis of age, “the grey divide”, which unless arrested soon must lead to a lack of continuity and the loss of a major resource – a vast bank of knowledge and expertise gained through experience (and thus the loss of mentoring).

- Many geologists who were once long-term corporate and government employees are now temporary contractors or consultants – they represent surge capacity to be employed at peaks of cycles, and are currently under-employed.

- There is a vicious circle where the “unpopularity” of geoscience (and science generally) leads to lower entry requirements at universities which leads to a further decrease in appeal (and one supposes to a reduction in the average calibre of earth science students notwithstanding that for some it will simply be the field of choice).

- Presumably there is or will be an iterative effect unless counteractive steps are taken whereby reduced industry activity, reduced discretionary R&D funds and reduced student numbers will adversely affect research spending (universities, CSIRO) curtailing Australia’s current exploration leadership role.

POSITIVES

The positives are:

- The mining industry is not in a terminal phase, ie. unless there is catastrophic global disruption, and despite increasing re-use, re-cycling and substitution, metals and mineral commodities will continue to be in demand – mining is essential to society.

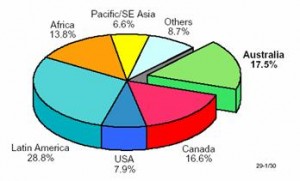

- Australia has been able to maintain its position as the most favoured single country in which to undertake mineral exploration in spite of a reduction as a proportion of global mineral exploration spending from around 20% in the early to mid 1990’s to 17.5% in 2001 (Figure 4).

Figure 4. Share of global exploration expenditure (2001)

- As a consequence of Federal and State/NT Government programs, Australia has one of the best, if not the best, geoscience information bases in the world. Collectively, the governments have spent more than $450 million in the period 1990-2000 on precompetitive geoscience information, mostly in support of minerals exploration.

- The disposal of some non-core assets by majors to juniors has created new opportunities and, in some cases, cash flow for the junior company to support exploration.

- There are some limited early signs of increased investor activity, particularly in Canada, but even if this is sustained we are firmly past the mining and exploration “glory years” (arguably the three decades from 1950 to the early eighties).

- Majors appear to be increasingly conducting at least some of their exploration through strategic alliances and joint ventures with junior exploration companies.

COURSES OF ACTION

Courses of action:

If the mining industry is to continue to underpin Australia’s standard of living, it has to be comprehensively competitive globally and a major effort is required on a number of fronts. The following represents some of the actions required:

- Australia must enhance its current preferred status for mining and mineral exploration by

- rapidly finding economically and socially viable solutions to land access difficulties following the Native Title Act and the High Court’s Wik decision in 1996

- introducing tax incentives including a tax credit similar to the Canadian “flow-through shares” scheme of the 1980’s and revived in 2001, and some form of R&D recognition

- increasing the generation and availability of public geoscience data through continued support of, and focused practical application by, the Federal and State mineral resources agencies

- overcoming the lack of progress in resolving environment/regulatory issues.

- Australia must maintain at least a leading and preferably a dominant position with respect to mining and exploration technologies by

- campaigning to enhance the public perception of science and engineering as professions

- sustained support of a rational framework of properly resourced teaching centres or “collectives” at both undergraduate and post-graduate level

- long-term commitment and funding, including industry participation, in our research centres (universities, CRCs, CSIRO) for applied exploration, mining and mineral processing research

- a revival of R&D funding to support research into materials science (Editor: see also “Federal Government to Prioritise Technology Research”, in this issue).

- concentration by some smaller companies on locating niche opportunities, eg. deposits that are too small, or for end products that in a market sense are not big enough, for the major companies.

Lobbying of Federal and State Governments must concentrate on the impact that the loss of export earnings from mining will have on the Australian economy, not on the loss of geoscientists; I understand that the former is indeed AIG’s approach.

A promising development is the proposed Minerals Industry Action Agenda which has been prepared and submitted to the Minister for Industry, Tourism and Resources; this has the very strong support of the majority of industry associations and there is optimism that this Action Agenda will be one of those selected for consideration by the Prime Minister and potentially Cabinet – a decision is due in July.

At the State level, a WA Ministerial Inquiry will seek submissions from major industry bodies regarding reasons for the reduced levels of private investment in greenfields mineral exploration and recommended actions to achieve a sustainable future.

WHERE HAVE ALL THE GEOSCIENTISTS GONE?

So, finally, where have all the geoscientists gone?

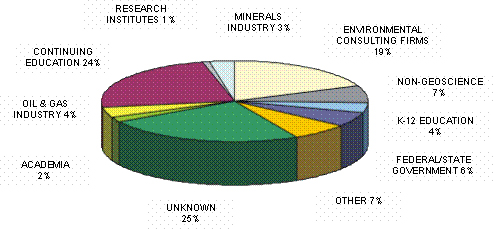

- In North America 3% of recent undergraduates have entered the minerals industry; 19% have joined environmental consulting firms (Figure 5).

Figure 5. Employment trends of recent undergraduates

(Source American Geological Institute)

- The older (45-50+?) geoscientists, presumably partly because of their personal commitment and time invested in the profession and partly as a result of the difficulties faced in competing for employment in a different field, have largely remained within the industry – often in contracting, consulting or in more entrepreneurial roles such as putting together IPOs; or they have retired (often early).

- An unquantified number of younger professionals have transferred to environmental geoscience, hydrogeology and geotechnical work.

- In Perth, where 36% of our national geoscientists reside, 65% of the generally more senior industry professionals made redundant were re-employed, but 48% of these changed industry; 25% are now self employed, in part contracted back to their original companies; 10% remain unemployed.

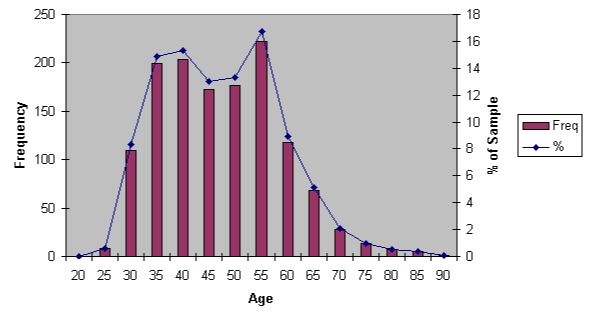

- A large proportion of the 2600 “missing” industry professionals are of a mixed but generally younger age where, deterred not only by job insecurity but also in some cases compounded by the desire for a stable location, they have left and pursued alternatives, often after retraining. It should be noted that a proxy age distribution (Figure 6), based on the individual’s year of completing high school as recorded in the Directory of Australian Geoscientists, is rather paradoxical when considered against that expected by observation in that it is not as skewed as expected. Anecdotally the list of new occupations includes child bearing and rearing, school teaching, day trading, investors, newsagents, professional photography, park rangers, real estate agents, financial advisers, stockbroking analysts, growing plantation trees, re-filling and re-selling ink-jet cartridges, handyman, sports store manager, GIS applications (including marketing), information technology, viniculture.

Figure 6. Approximate age distribution of remaining geoscientists

REFERENCES

Particularly plagiarised references:

Jaques A.L. and Huleatt M.B. 2002. Australian Mineral Exploration : Analysis and Implications. Bull. AusIMM, 1, 45-52

Snow G.G. and Juhas A.P. 2002. Trends and Forces in Mining and Mineral Exploration. Soc. Econ. Geol., Special Publication, 9, 1-16

Received: May 2002

Published: July 2002

Copyright The Australian Institute of Geoscientists, 2002