Andrew Scogings, Ralph Porter and Graham Jeffress

Principal Geologists, CSA Global Pty Ltd

Level 2, 3 Ord Street, West Perth WA 6005, Australia

Click here to download paper as PDF

Abstract

Growing demand for rechargeable batteries has led to industrial minerals such as graphite and lithium becoming the focus of attention for exploration and mining companies. Consequently, the race has been on to report exploration targets and Mineral Resources.

The requirements for publicly reporting the outcomes of Australian company activities remain underpinned by the requirements of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (‘the JORC Code’) and the listing rules of the Australian Securities Exchange (ASX).

As with all other commodities, public reports about lithium exploration targets, exploration results and Mineral Resources require the input of suitably experienced Competent Persons presenting material information in a transparent way.

This paper examines lithium production markets and prices, reporting of exploration results, special considerations that should be applied to the reporting of pegmatite Mineral Resources and issues around Competence for the public reporting of lithium exploration results and resources.

Introduction

Industrial minerals such as graphite, and latterly lithium minerals, have become the focus of attention for listed exploration and mining companies. This is mainly due to developments in rechargeable battery technologies, driven by growing demand (real or anticipated) from the emerging electric vehicle market and solar storage sectors. Consequently, the race has been on to acquire tenure, report larger exploration targets and resources, and to tell the market why one’s project has merits superior to competitor projects.

Additionally, the competition for scarce investment dollars has inspired innovative exploration approaches, as well as creative ways to tell the story of exploration success.

In Australia, the requirements for publicly reporting the outcomes of any publicly listed company’s activities are specified by the JORC Code and the listing rules of the Australian Securities Exchange.

As with all other commodities, public reports about lithium exploration targets, exploration results and Mineral Resources require the input of suitably experienced Competent Persons presenting material information in a transparent and material way.

This article discusses a few important aspects of pegmatite lithium deposits, the nature of the products derived from them, and some of the idiosyncrasies of these deposits that require specific disclosure in public reports.

Lithium production and markets

According to the United States Geological Survey, approximately 32,500 kt of lithium (equivalent to approximately 172 kt of lithium carbonate equivalent, or ‘LCE’ which is the standard industry unit for sales and comparisons) was estimated to have been produced in 2015 (Jaskula, 2015).

Lithium is produced from two main deposit types, namely brines (60% of global production, mainly from South America) and pegmatites (40% of global production, dominated by Western Australia). Other deposit styles, notably lithium-borate-carbonate deposits such as the Jadar deposit in Serbia, and deposits with lithium-bearing clays are being evaluated in Mexico, USA, and Turkey. Most current interest in lithium-bearing clays is focussed on deposits in Mexico (Sonora) and USA (Nevada).

Rare element granitic pegmatites comprise two major minerals of current economic interest: spodumene and, to a lesser extent, petalite (Figure 1, refer to Table 1 for some lithium mineral examples). Lithium in pegmatites may also be present in micas such as lepidolite. Lithium frequently occurs with other metals that potentially contribute value to projects and need to be appropriately considered during resource evaluation, most notably tantalum in the case of pegmatite deposits.

There are many lithium minerals, which are characterised by distinctive (and often complex) chemistry, and a range of bulk densities (Table 1). These minerals may also contain potentially deleterious or undesirable elements such as iron, phosphorus, or fluorine.

Table 1. Examples of some lithium-bearing minerals found in pegmatites

| Principal lithium minerals in pegmatites | Formula | Density (average; g/cm3) |

Lithium % (calculated) |

Li2O% (calculated) |

| Spodumene | LiAl(Si2O6) | 3.2 | 3.7 | 8.0 |

| Petalite | Li(AlSi4O10) | 2.4 | 2.3 | 4.9 |

| Eucryptite | LiAl(SiO4) | 2.7 | 5.5 | 11.8 |

| Amblygonite | LiAl(PO4)(OH) | 3.0 | 4.8 | 10.2 |

| Lepidolite | K(Li,Al)3(SiAl)4O10(OH,F)2 | 2.8 | 3.5 | 7.6 |

| Lithiophilite | Li(Mn2)PO4 | 3.5 | 3.3 | 7.1 |

| Zinnwaldite | K(Al,Fe,Li)3(Si,Al)4O10(OH)F | 3.0 | 2.9 | 6.2 |

Note: actual content of Li in natural minerals may be lower than calculated. Density and Li contents rounded to first decimal place

Figure 1. Hand specimen of petalite, spodumene, feldpar and quartz with minor mica,

from a pegmatite outcrop. Sample length approximately 15cm.

Various lithium minerals and compounds are used across a range of markets dominated by batteries (approximately 35% and growing) and glass and ceramics (approximately 30%). Smaller markets include applications in lubricating greases and air conditioning dehumidifiers.

This range of end uses and products is a key difference from many other metal commodities and highlights the fact that, like other industrial commodities such as graphite or iron ore, the value of the products from these deposits depends on end user requirements and a variety of parameters beyond just the concentration and distribution of lithium, the primary element.

Processing Methods

Pegmatite deposits are currently being mined both by open-cut and underground methods, with open-cut mining the far more common.

Lithium-bearing pegmatites may be zoned or unzoned, and are dominated by minerals such as feldspars (K-feldspar/Na-plagioclase) and quartz. The more common lithium-bearing minerals such as spodumene, petalite and lithium mica species typically comprise around 20–25% of the economic pegmatites. Trace amounts of other minerals of potential commercial value, such as beryl, cassiterite and tantalite, are also often present.

Lithium minerals, such as spodumene and petalite are generally separated from other pegmatite minerals by flotation and gravity separation methods. Low intensity magnetic separation may also be used to remove tramp iron (from grinding balls), while paramagnetic minerals such as tourmaline may be removed using high-intensity magnetic separators (Garrett, 2004).

Downstream processing lithium mineral concentrates may follow several routes. Typically, to extract lithium from spodumene, the crystal structure of spodumene must be converted from the naturally occurring monoclinic α-form to the tetragonal β-form by roasting to about 1,000°C. This makes the spodumene amenable to leaching with sulphuric acid, which forms soluble lithium sulphate, from which Li2CO3 may be precipitated using soda ash. Other agents including Na2CO3 or HCl have been tested and could be of application depending on the final product desired and levels of impurities present.

Several other lithium extraction technologies have recently been proposed for pegmatite and brine deposits, based on leaching, solvent extraction, geothermal extraction, and electrolysis. Of these, the concept of leaching with sulphuric acid has gained some traction for the processing of micaceous minerals such as lepidolite or zinnwaldite. Importantly, this method does not use roasting, thereby reportedly reducing cost.

Lithium prices

Lithium minerals and lithium compounds are priced mainly according to size and/or purity specifications. For example, spodumene concentrates for industrial applications such as ceramics and glass are graded according to their iron and/or lithium content.

Prices for lithium mineral concentrates (as reported in Industrial Minerals Magazine, www.indmin.com), have recently ranged between US$170 – US$265 per tonne of petalite (4.2% Li2O, FOB Durban) and US$755 – US$780 per tonne of spodumene concentrate (7.5% Li2O, CIF Europe).

Lithium carbonate and lithium hydroxide, which are manufactured from lithium minerals, command far higher prices and according to Industrial Minerals Magazine, range between US$6,500 and US$8,500 per tonne of lithium carbonate (99-99.5% Li2CO3, CIF Asia) and US$8,300 and US$11,000 per tonne of lithium hydroxide (56.5-57.5% LiOH, delivered Europe).

It is clear that such substantial product price ranges could have a significant impact on the economics of a lithium pegmatite project, requiring a thorough understanding of the products likely to be produced from a potential mine.

Reporting of exploration results (JORC Code Clause 19)

Lithium content may be reported in a number of ways (Table 2) and it must be made clear which is being used. For example, analytical laboratories may report elemental lithium (Li), whereas Mineral Resources are usually reported as lithium oxide (Li2O). Global lithium production is frequently reported as lithium carbonate (Li2CO3).

Table 2. Ratios for converting lithium (Li) values to various lithium compounds

| Li | Li2O | Li2CO3 | LiOH | |

| Ratio | 1.00 | 2.15 | 5.32 | 6.06 |

| % Li | 100 | 46.4 | 18.8 | 16.5 |

Lithium mineralogy is as important as Li2O content and, consequently, must be discussed when reporting exploration results to follow the requirements of the JORC Code (JORC, 2012). It is unacceptable to only report lithium contents (e.g. Li2O %) without specifying which lithium minerals are present and the form in which they occur in the deposit. The nature and concentration of potentially deleterious components also need to be discussed (JORC, 2012). There are significant economic implications associated with the form in which lithium occurs and compliance with the transparency principle of the JORC Code requires the main mineral species present and their physical characteristics in a deposit to be described.

To this end it is highly recommended that in the early evaluation stages, samples of the minerals of interest be sent for XRD or petrographic analysis prior to, or in parallel with, chemical analyses.

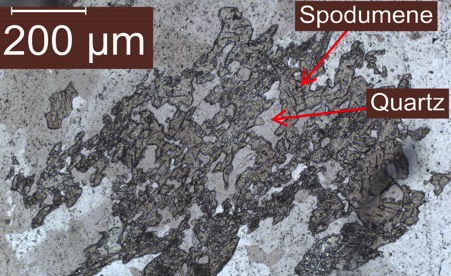

While coarsely crystalline spodumene can be very distinctive in hand specimen (Figure 1), in finer crystals it can prove challenging to reliably identify and petalite is very similar in form to feldspar, making it very difficult to distinguish visually (Figure 2, Figure 3). Similarly, lepidolite or zinnwaldite may be visually indistinguishable from other white micas in core and hand specimen.

Figure 2. Petalite-bearing pegmatite in HQ drill core. Depths in metres

Semi-quantitative XRD estimates of the mineral phases present is an option and there are advanced techniques that can provide an estimate of the proportion for each mineral present in a sample. These methods test fine powders, and are therefore applicable to RC percussion and core pulps.

Another potential complication is that secondary alteration/weathering derivatives of spodumene, such as eucryptite, can contribute to Li2O analyses, but may not be recoverable during processing.

It is recommended, therefore, that public reports of lithium results not be released until chemical analyses are available and are, preferably, supported by XRD and/or petrographic data.

In those instances where a company determines that continuous disclosure obligations require the public release of drilling results prior to receipt of the laboratory analytical results, it is essential that the Competent Person disclose information on both the identity and quantity of the lithium minerals observed. It is not sufficient to quote intervals of pegmatite without providing at least an estimate of the contents of the lithium minerals of interest. Such information should be provided as ranges of percentage estimates, and include cautionary language about the inherent uncertainty of visual estimates and the importance of laboratory confirmation (Waltho, 2015).

Figure 3. Spodumene Quartz Intergrowth (SQI) in thin section

An exploration company may wish to publish exploration results and there are very clear guidelines in the JORC Code Clause 19, which highlight that “Public Reports of Exploration Results must contain sufficient information to allow a considered and balanced judgement of their significance.” and “Public Reports of Exploration Results must not be presented so as to unreasonably imply that potentially economic mineralisation has been discovered.” (JORC, 2012).

It is important to present sufficient information to understand the likely thickness of lithium-bearing pegmatite. Except in the case of very large pegmatites, it is unlikely that selective mining, targeting higher grade zones, will be possible. Generally, the full thickness of a pegmatite is mined and sent for processing. Therefore, selective reporting of maximum Li2O grades from within a drill hole or of relatively narrow intervals within a pegmatite is likely to be misleading. As stated in Clause 19 of the JORC Code:

“Where assay and analytical results are reported, they must be reported using one of the following methods, selected as the most appropriate by the Competent Person:

- Either by listing all results, along with sample intervals (or size, in the case of bulk samples), or;

- By reporting weighted average grades of mineralised zones, indicating clearly how the grades were calculated.”

Also, it is very important to support a clear understanding of the exploration results:

“Clear diagrams and maps designed to represent the geological context must be included in the report. These must include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views.”

The authors propose that there will be very few cases where a collar plan, or a plan showing collars, drill hole traces and projections of mineralised intersections at surface, and an appropriately annotated cross section are not required when presenting drilling results.

Crystal size and orientation may vary according to the type of pegmatite being explored, e.g. zoned pegmatites are often more coarsely crystalline and the target minerals are often confined to distinct zones compared with unzoned (homogenous) pegmatites. The typically coarse crystal size of pegmatites also presents distinct challenges in collecting representative samples. Inspection of standard sampling nomograms quickly reveals that practical sample sizes are invariably much smaller than recommended for deposits with the crystal sizes frequently encountered in mineralised pegmatite mineralisation.

In drilling this can be addressed by using large hole diameters and numerous field duplicates. RC percussion drilling may provide the better sampling option, particularly for resource definition, in due to the relatively large sample volume produced relative to most cored drilling and the ability of splitters on the drilling rig to collect samples for analysis and additional splits for future reference or blind resubmission for analysis. Non-cored drilling, however, may not provide meaningful information regarding the sizing of minerals of potential economic interest and impede visual recognition of lithium bearing minerals. The latter will, however, be detected by spectrometric mineral identification methods such as XRD. Core drilling should ideally use PQ or, at minimum, HQ diameter core, and samples should ideally comprise three-quarter core, or even full core that has been carefully photographed to provide a meaningful record of drilling results, in conjunction with geological logs, for future reference.

Reporting analytical results for grab samples or hand specimens should be treated with caution as the coarse crystal size of most zoned pegmatites makes selection of unbiased samples essentially impossible. Similarly, it is critical to discuss the likely dimensions of the pegmatite body being sampled. An isolated vein of limited width or length is unlikely to be of immediate, potential economic interest, regardless of the lithium content (even though small outcrops can lead to the discovery of significant deposits). Again transparency in public reporting is key to adequately informing the reader and ensuring JORC (2012) compliance.

For surface sampling, it is recommended that channel samples be carefully considered as the preferred option. Once interest in a project has been established, the collection of bulk samples to provide both representative samples of the pegmatite and also to provide sufficient material for metallurgical characterisation and test work is advantageous.

Context is ‘king’. It is essential that the reader appreciates the risk inherent in uncertainty that is invariably present in the early stages of any potential resource project development.

Reporting Pegmatite Mineral Resources (Clause 49)

Industrial minerals are essentially minerals and rocks mined and processed for the value of their non-metallurgical properties. Industrial minerals are commonly classified according to their end uses, where there are a diverse (and sometimes bewildering) number of specifications addressing, for example, chemical purity, mineralogy, particle size distribution, whiteness, density, water absorption, thermal resistance, rheology and insulating properties.

Lithium minerals have traditionally been classed as industrial minerals, which was the case when most lithium minerals were used for their non-metallurgical properties. For example, low-iron petalite and spodumene added to glass and ceramics to reduce firing temperatures, increase furnace throughput and also improve properties such as thermal stability (e.g. oven-to-table ware).

However, with the growth of demand for lithium compounds such as lithium carbonate and lithium hydroxide for use in batteries, it can be argued that lithium minerals are no longer strictly industrial minerals but, instead, should now be considered to be hybrid commodities that overlap in nature with traditional metal commodities, especially bulk commodities such as bauxite and iron ore. Nonetheless, specifications such as the iron and Li2O content of concentrates, are still critical for downstream chemical processes and drive the value of lithium products. Consequently, these characteristics underpin assessments of what may be eventually economically extractable and, accordingly, constitute a Mineral Resource.

According to Clause 49, for minerals that are defined by a specification, the Mineral Resource or Ore Reserve estimation must be reported:

“in terms of the mineral or minerals on which the project is to be based and must include the specification of those minerals.”

Further references to specifications are found in the JORC 2012 (Clause 49) guidelines, for example:

“Some industrial mineral deposits may be capable of yielding products suitable for more than one application and/or specification. If considered material by the reporting company, such multiple products should be quantified either separately or as a percentage of the bulk deposit.”

In the case of a lithium pegmatite project, Mineral Resource tonnes and lithium content are key metrics, but such projects also require attributes including mineralogy and concentrate purity (discussing the concentration of deleterious components, particularly Fe, P, F) to be evaluated. Neglecting to provide all this information in a transparent fashion could be misleading to investors, as without product information it is not possible to estimate the market price that may be achieved and the application of meaningful economic modifying factors during technical studies.

Consider the case of a hypothetical lithium pegmatite Mineral Resource reported as 20 Mt at 1.5% Li2O. Essentially all this tells us is that the resource contains 0.3 Mt of Li2O, but this tells us nothing specific about:

- what mineral species are present;

- whether lithium is present in minerals that may be recovered using conventional flotation, gravity or magnetic separation technologies;

- the potential need for roasting;

- the likely purity of concentrate(s) that may be produced from mineralisation;

- impurities such as iron or fluorine that may impact on industrial applications; nor

- whether lithium can be extracted from the lithium minerals to produce acceptably pure lithium carbonate or other compounds.

Certain projects may also claim to have cassiterite, tantalite and other metal credits. It cannot be assumed, however, that the tantalite minerals can be extracted, or may be saleable, until the results of metallurgical test work are available. To this end it is important to remember Clause 50 of JORC (2012) should any discussion of metal equivalents be considered.

Public reporting of LiO2 equivalent grades by companies is not common practice, with more attention appearing to be focussed on the quality of the end product rather than run of mine ore becoming evident, particularly in European markets. However, the quality of the end product will, in many cases, depend on the processing steps selected to purify the ore. Practical processing workflows are frequently not properly demonstrated. Many companies are currently assuming that standard processing methods will be applicable for their deposits, and only when projects progress to an advanced stage do they report actual recoveries (if they do at all).

Appropriate Quality Tests (Chemical Analysis)

The responsibility falls on the Competent Person to ensure that exploration samples are tested for appropriate parameters, required to meaningfully assess resource potential, in addition to basic tests for lithium content. Clause 49 of JORC (2012) provides guidance to Competent Persons that chemical analysis of the primary metal of interest may not always be the most relevant criteria in assessing a deposit, and other criteria such as mineral species and quality criteria may be more applicable. This is frequently the case for minerals with industrial applications, although knowledge of deleterious components is required data for almost any form of mineral deposit. If criteria such as deleterious minerals, contaminant elements, or physical properties are in any way relevant, they should be reported accordingly with equal prominence to the mineral of principal economic interest.

In many ways, lithium analysis, today, is in a similar place to that gold was in 30 years ago. The theory is understood but the practical experience is lacking. Laboratories are confronted by difficulties in obtaining supplies of suitably clean fluxes such as sodium peroxide to provide low detection limits useful for grass roots lithium exploration (e.g. soil or laterite samples). At the other end of the lithium content spectrum, laboratories still struggle to reliably analyse ore-grade material without numerous dilutions and costly rehandling. There are a paucity of readily available, reliable lithium standards and reference materials.

In order to demonstrate the potential for eventual economic extraction at the Mineral Resource estimation stage, it is recommended that the following points are considered:

- What minerals are present in the mineralised rock?

- If there are several lithium minerals, can they be recovered and processed economically?

- How pure are the minerals? For example, there could be small quartz intergrowths that reduce concentrate purity, as with spodumene quartz intergrowths (SQI), which typically forms as a replacement of petalite?

- What liberation methods are required or viably applied e.g. gravity, floatation and cleaning to produce concentrates of acceptable size distribution and purity?

- How does the liberation grind size affect other minerals such as niobium-tantalum minerals that may also be of potential economic interest?

- If lithium mica-bearing minerals such as lepidolite or zinnwaldite are present, are there potentially deleterious elements such as fluorine that may need to be accounted for during lithium extraction?

- Can lithium carbonate of suitable quality be produced using, for example, pyrometallurgy and hydrometallurgy or acid leaching?

Competence and Responsibility (Clauses 9 and 11)

The JORC Code (JORC, 2012) states that:

“A Public Report concerning a company’s Exploration Targets, Exploration Results, Mineral Resources or Ore Reserves………… must be based on, and fairly reflect, the information and supporting documentation prepared by a Competent Person.” Clause 11 goes on to describe a Competent Person (CP) as having “a minimum of five years relevant experience in the style of mineralisation or type of deposit under consideration and in the activity which that person is undertaking.”

So, just who is a Competent Person when it comes to lithium pegmatites, and what constitutes “relevant experience”? To try and answer this, we return to the Code and find the key guidance that says:

“As a general guide, a person being called upon to act as Competent Person should be clearly satisfied in their own mind that they could face their peers and demonstrate competence in the commodity, type of deposit and situation under consideration. If doubt exists, the person should either seek opinions from appropriately experienced peers or should decline to act as a Competent Person.”

This is ‘hand on the heart’ stuff to say the least. You might not need to have five years solely on lithium pegmatites, especially if you have a significant time in industry, but without some experience in pegmatites as economic targets, then is difficult to see how a claim to be a Competent Person in lithium pegmatites can be defended.

Let’s take the case of some hypothetical aspirant Competent Persons and assess if they really are competent to publicly report on lithium pegmatite exploration results and resources.

- Geologist A: MSc degree in industrial mineralogy. Forty years of industrial minerals experience including exploration, product development and QC laboratory management. Very aware of market specifications. Some experience of spodumene pegmatite exploration about 20 years ago.

- Geologist B: BSc degree. Three years’ experience since graduation, mainly in greenstone hosted gold. Has logged holes that were drilled through pegmatites that may have been lithium-bearing.

- Geologist C: MSc degree. Thirty-five years of geological exploration experience, mainly in base and precious metals and credited with some significant discoveries. Approximately five years of ‘hands on’ involvement in exploration for tantalum-bearing pegmatites. Very aware of the significance of different lithium minerals from the perspective of exploration and downstream processing.

- Geologist D: PhD in granitoids. Diverse career over 20 years covering a range of terranes and commodities, substantial track record in exploration management and discovery. Has never actively explored for industrial minerals or rare element granitic pegmatites.

- Geologist E: BSc (Hons). 25 years’ experience in exploration, development and production for gold and copper. Experienced in running a small company and writing ASX releases. Has spent most of the past 18 months’ work on near-mine lithium exploration and resource definition, including addressing quality assurance and analytical problems.

Our contention would be that geologists A, C and E have the relevant experience in lithium pegmatites to be Competent Persons for public reports in compliance with the JORC Code. The others, Geologists B and D, should seek the advice of A, C or E.

Concluding Remarks and Observations

When publicly reporting lithium pegmatite exploration results or mineral resource estimates in compliance with the JORC Code (JORC, 2012), the following points should be considered:

- Are you a Competent Person for lithium in pegmatites? – do you have a minimum of five years’ relevant experience in the deposit type/commodity? Will your peers agree with your assessment of competence?

- Refresh your memory on clauses 9–11 (CP), 17 (ETR), 18–19 (ER), 21 (MRE), 49 (IM) and 50 (ME) of JORC (2012) before preparing a public report.

- If you need to report visual estimates prior to laboratory results, then you must identify the minerals of interest and include estimates of abundance (as ranges).

- Make sure you are collecting representative samples and have sufficient quality control to demonstrate the robustness of the analyses.

- Take the largest samples possible, consistent with the coarse-grained nature of pegmatite mineralisation.

- Always get confirmation of the mineralogy as early as possible (e.g. by XRD) in the exploration and evaluation of prospects.

- There is rarely an excuse for not having a map of sample locations, drill holes and geological sections of the drill holes.

- Be very wary of ‘cherry-picking’ better results – pegmatites are most commonly exploited by bulk mining methods.

- Specific market-related testing and metallurgical test work are required for lithium pegmatite deposits. It is not sufficient to rely, solely, on traditional analytical tests as commonly used in exploration for other metals.

- A Mineral Resource estimate must include the specification of those minerals, where applicable. If you don’t think this applies, then you need to explain why this is not the case.

- If multiple products are possible from a deposit, each product should be quantified either separately or as a percentage of the bulk deposit. Proximity to markets and general product marketability should be taken into account.

In closing, let us remind ourselves that in the field of pegmatite science, relatively few pegmatite deposits have been actually studied and fewer completely understood. To repeat the famous observation by Donald H. Rumsfeld that concludes London’s (2008) excellent volume on pegmatites:

“The message is that there are known knowns – there are things that we know that we know. There are known unknowns – that is to say, there are things that we now know we don’t know. But there are also unknown unknowns – there are things we do not know we don’t know. And each year we discover a few more of those unknown unknowns”.

Given this context, it is imperative that reports about potentially economic pegmatites adhere to the JORC Code (JORC, 2012) and provide material information in a transparent fashion, prepared by a Competent Person.

Acknowledgements

The authors acknowledge CSA Global for permission to publish this review. The authors also wish to thank Jorge Garcia EurGeo and Andrew Waltho FAIG FAusIMM FGS RPGeo for reviewing and suggesting improvements to the manuscript.

While Graham Jeffress is a member of the Australasian Joint Ore Reserves Committee (JORC), the views expressed herein are personal and should not be taken as reflecting the position of the Committee.

References

Garrett, D.E. (2004). Handbook of Lithium and Natural Calcium Chloride. Elsevier Ltd., ISBN 0-12-276152-9.

Jaskula, B.W. (2015). USGS Mineral Commodity Summaries, January 2015.

JORC (2012). “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The JORC Code)”. The Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia.

London, D. (2008). Pegmatites. The Canadian Mineralogist, Special Publication 10. ISBN: 978-0-921294-47-4.

Waltho, A. (2015). “Reporting Sulphide Mineral Observations in Drilling Intersections”. AIG News 122 pp46-47

AIG Journal Paper N2016-001

Received 30 July 2016

Reviewed: 28 August 2016

Accepted: 1 September 2016

Published: 19 October 2016

Copyright © The Australian Institute of Geoscientists, 2016